Your money – well sorted for a better future.

Sustainable banking - without compromises

The monthly summary gives you a clear overview of your spendings. With Pockets, your practical sub-accounts, you can achieve your financial goals faster. And you can also invest your money 100% sustainably with our invest product .

Safe & mobile payment

Free Visa debit card with Tomorrow Design

Withdraw money worldwide and pay free of charge. Everywhere where Visa is approved.

Quick and easy mobile payments with Apple Pay & Google Pay

Your money supports sustainable industries. No weapons, no coal power, no factory farming. And with every card payment you enable the rehabilitation of ecosystems. 🌱

Other cool features

Shared account

Monthly summary

Deposit cash

Rounding Up

Climate protection

Real Time transactions & standing orders

Our strong partner in the background

The Tomorrow account is provided by our banking service provider, Solaris SE. Solaris SE is a fully regulated European bank, licensed and supervised by the German Federal Financial Supervisory Authority (BaFin). Euro deposits in the bank account are protected up to 100,000 Euro by the German Deposit Guarantee Scheme (DGS). This protection applies per customer / per bank - in this case Solaris. In case you have several accounts with Solaris, the deposit protection applies to all your accounts in total. This corresponds to the standard for all European credit institutions.

Your money is safe 🔐

With the app you are in control of your finances

Lock or unlock your card

Change your PIN

Define spending limits

Your money is protected by the national deposit insurance up to 100.000 €. This protection applies per customer / per bank and therefore applies to all your accounts with Solaris SE.

Pick your sustainable bank account

Our three sustainable bank accounts come with different features. Pick the one that suits your needs best.

Now

Mobile banking - easy & fast

€4 / month

Change

The everyday account - smart & flexible

€8 / month

Zero

The premium account with extra climate protection

€17 / month

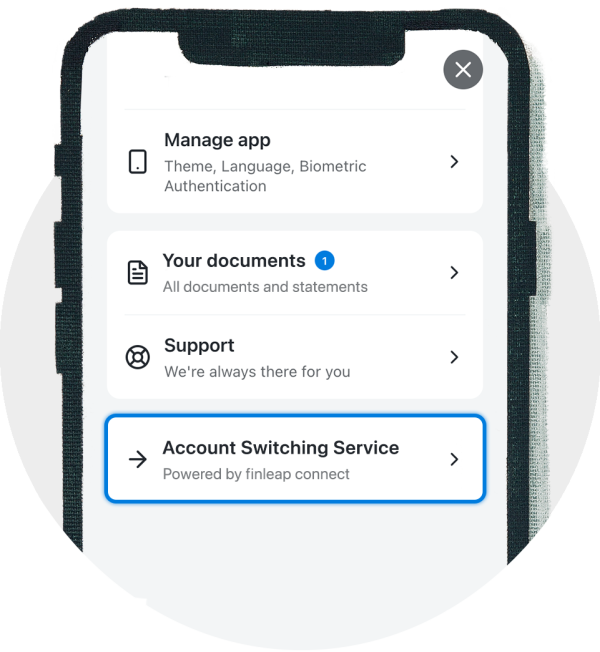

Switching accounts made easy: Together with our partner Qwist, we offer the free Tomorrow account switching service. This makes switching accounts quick and easy. All you need is your cell phone and your bank information.

Do you need help? We are always here for you.

Our experienced customer support is here to personally answer your questions.

Our answers to your questions 💬

Curious? Get started and download the Tomorrow App now.

Disclaimer & risk notice: The mentioned investment products are associated with risks as the value of your investments may increase or decrease in value. You may lose your invested money. Price developments in the past, simulations or forecasts are no reliable indicator of future performance.

The text does not contain investment advice or recommendations to buy or sell. Visualizations are for illustrative purposes only and do not represent actual or future performance of the fund.

Our partner Solaris SE is the provider of all banking services. Additionally Tomorrow GmbH offers the brokerage of the Tomorrow Better Future Stocks fund as a tied agent within the meaning of § 2 para. 10 KWG in the name and for the account of Solaris SE and is entered in the public register maintained by the German Federal Financial Supervisory Authority (BaFin). The register can be viewed at portal.mvp.bafin.de/database/VGVInfo/.