In the latest instalment of our “Finance Check” format, Lynn and Christian tell us how they organise their joint finances and how their budget is split. Let’s get started:

There are many ways to organise your finances in a relationship. But which one is right for you depends on so many different factors like how high your joint budget is, how many fixed costs you need to pay and your own wishes and expectations.

This time Lynn and Christian are revealing how they manage it, how much money they have at their disposal, which account model works for them and how they are making provisions for their old age.

How much of a net disposable income do you have each month?

I (Lynn) have 1,850 euros (plus a company car) and Christian also has 1,850 euros. Together that makes a budget of 3,700 euros a month.

That means you have an equal income?

It works out pretty equal over the year. I (Lynn) have a company car on top of my wages. And Christian also gets a bonus every now and again, at Christmas, for example, or after a good month.

Are you renting or buying?

We rent a 125 m² apartment.

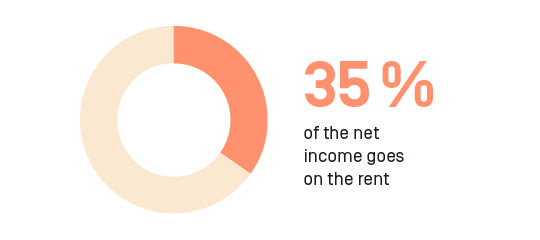

What percentage of your wages goes towards your rent?

We pay 1,300 euros a month, which is 35% of our monthly budget.

Do you live in the city or the country?

We live in a city in Schleswig-Holstein, but it’s actually really close to Hamburg.

How do you organise your finances?

Each of us has our own account, where our own wages are paid into, and we have a joint account into which we both pay the same amount (currently 1,000 euros) every month. We use that money to pay for the rent, electricity, internet and food. We each cover the costs for our hobbies individually and take it turns to pay for small purchases. Rather than splitting the bill each time, we just take it in turns and figure it will all even out in the end.

How are you planning for your old age?

We both have the statutory pension insurance. I (Lynn) am paying into fund-based savings plans and Christian is also planning on doing the same in the future. Insurances aren’t the right option for us as we believe that the costs are too high and the rate of return too low. Instead, with the money we save we’re planning on buying properties together in the long term and renting them out. But we also keep our eyes open for other options to save for the future and always keep up to date with new investment products.

Would you both have financial security if you were to split up?

If we were to split up, we would each have to find our own place to live as the flat we currently live in would be too expensive for one of us on our own. We don’t need to worry about childcare so we don’t owe each other anything in that respect. But if we did have children, we would certainly reduce our working hours equally and split the childcare 50/50, so both of us would be paying the same amount into our pensions and have the same career development opportunities – and both of us could spend the same amount of time with the children.

We have to make clear calculations if we are planning bigger purchases that might need to be financed.

What is particularly important to you in your relationship when it comes to money?

It’s very important to us to be completely honest and transparent with one another. We have to make clear calculations if we are planning bigger purchases that might need to be financed, so we really need to know what’s going on in each other’s accounts. It also makes sense to look at your liquidity in the long term and to see what is really being deducted from your account each month. Sometimes the financial situation doesn’t feel particularly relaxed, despite setting money aside, when you look at how much you’re left with at the end of the month, once you’ve paid all other costs and for your hobbies etc. But we check in with each other and talk about our financial situation on a regular basis.

Find out more

Read Katharina and Leon’s Finance Check here. Together they have a joint budget of 5,900 euros a month. They told us how they are managing their money, now and for the future.

And here you can find the first edition of our Finance Check with another four couples who told us how much they earn, how they organise their finances and how they are making future provisions.

Do you want to use a joint account but aren’t quite sure how to merge your finances yet? Here are two specific examples to help you.

Du willst mobiles, nachhaltiges Banking? Dann eröffne jetzt dein Tomorrow Konto.