Before we go any further, let’s turn our attention to the subject of saving: The financial basis called "nest egg" or "rainy day fund". How should you best go about it and how much should you reasonably look to set aside? Find out here.

When addressing new subjects for the first time, it makes sense to define the basic principles. And financial matters are no different. Anyone who’s looking to invest some money, or to provide for their future in any other way, needs money that they can spare at the end of each month or that they won’t need just in case their car breaks down or the fridge stops working. And sadly, we all know that these kinds of situations crop up all too frequently. In the worst-case scenario, you can then end up not having enough money to make ends meet. Having to resort to your portfolio to make up the shortfall is almost as bad. It’s usually a bad idea to draw on funds before their redemption date – but we’ll come back to this another time.

So, there’s really no alternative: unless you’re banking on winning the lottery or suddenly inheriting a nice little nest egg – which would also have to happen at exactly the right time, of course – you have to build up reserves of your own. And by that we mean savings.

Get yourself an overview!

Okay, so I’m ready to start saving. What’s the best way to go about it? Before you embark on saving for a rainy day, you need to take a step back and look at the big picture. Are you still paying off loans, or making payments for purchases like furniture or gadgets? And what about any overdrafts you might have? It really is key to have a clear picture of all this in your mind. The first thing you need to consider is what lies within the realms of possibility. Then there’s the fact that you definitely don’t want to tie yourself down to paying overdraft interest longer than absolutely necessary.

Interest on overdrafts varies considerably and may be anything between 4 and 14%, which can make hefty inroads into your cash if you have an overdraft over a long period of time. But even the attractive 0% finance deals advertised by furniture shops and the like don’t necessarily make products a better buy. On the contrary, they tempt you to buy in the first place – and perhaps to spend more than you can afford. And once you’re hooked, it happens again and again….

If you’ve got a rather large overdraft and become dependent on it in the long term, you should also look at alternatives. There are always other solutions, even though you might not be aware of them. One option would be to try and transfer your debt to a loan that you pay back in instalments, as these generally have much lower interest rates. This can make quite a difference, depending on the sums involved, not least because you can pay off the money you owe sooner.

Saved money needs a home of its own

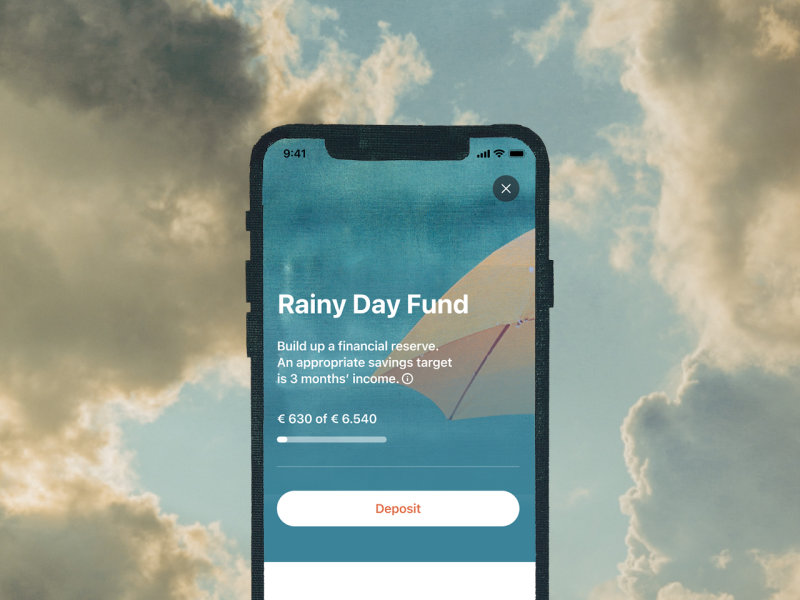

Once you’ve sorted out any debts, you can look ahead to saving. Around three months’ salary is usually assumed to be a good benchmark for the amount you should be thinking of setting aside. And the best place for this is certainly not your current account, but an sub- or deposit account. The Tomorrow app offers you “Pockets” for this very purpose: sub-accounts that you can set up with just one click. Simply create a pocket called “Savings” or “Rainy Day”, start saving and off you go!

Since July 2022, there is an additional pocket "Rainy Day Fund" preset in your Tomorrow app. This pocket is specially designed for building up your financial reserve. It calculates the amount of your nest egg based on your net income. All you have to do is set a monthly savings amount and you're ready to start saving.

Once you’ve saved the amount you had in mind, you can access it as and when you like. Just make sure you top it back up on a regular basis.

Whichever option you choose, at least the money isn’t just sitting in the account you use to pay your monthly bills. If you leave money in the same account, there’s a good chance that, sooner or later, you’ll eat into your reserves. So when you come to make your next purchase, you’ll no longer have to think whether you’ve budgeted for the item in question or whether you’ve already spent up to your limit.

Saving doesn’t need to be a sprint to the finish

You can decide for yourself how long you want to take to reach your savings target and how much money you can afford to put aside each month. And whether you set aside five euros or 250 euros a month, both amounts mean you’ve taken the plunge and made a start towards your savings target. And make no mistake, that’s a huge achievement!

It also makes sense not to be too set in your ways or even overenthusiastic at the beginning. This is a sure-fire way to lose your appetite for saving before very long. It’s far better to start with small amounts if you’re not sure what you can afford to put aside each week or month.

Savings give you more options

If you are able to build up some savings, it’s a good idea to set aside as much as you can. Not only does this create a good foundation for everything else, but for many people, saving sounds much more mundane than it actually is. 50 percent of the Germans have assets of only 3,682 euros – including tangible assets like property. This is a surprisingly low figure, but one that is very important nonetheless. It shows quite clearly that you have to be able to afford to save – and not all of us are in a position to do so. So, if you can afford to save, why not take that next step? It will offer you more freedom to make decisions, to make your wishes come true or even to resolve financial problems.

Let’s be honest, the very first time you have to resort to your rainy day fund instead of spending a sleepless night worrying about where the money is going to come from, you will realise that although saving may sound boring, in actual fact it’s anything but. Going back to basics, it offers you one thing above all else: more security.

So when will you make a start?

Are you ready to give it a go? Have a look at your accounts tomorrow and start by checking your outgoings. Then you’re ready to go. Yes really! It doesn’t make sense to have a rainy day fund unless you’ve taken this first step, but once you have, you’re all set.

Still not ready to take the plunge? Perhaps you should take a closer look at our Money Mindset advice, which might just help to make things clearer in your mind.